Inherited rmd calculator 2021

If you inherited an IRA from your spouse you have the choice of either moving the money into your own IRA or into an inherited IRA. We researched it for you.

How To Determine And Take Your Rmd Richard A Hall Pc

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

. Get your own custom-built calculator. Use this worksheet for 2021. The IRS has published new Life Expectancy figures effective 112022.

This calculator has been updated for the. Maya inherited an IRA from her mother. You reached age 72 on July 1 2021.

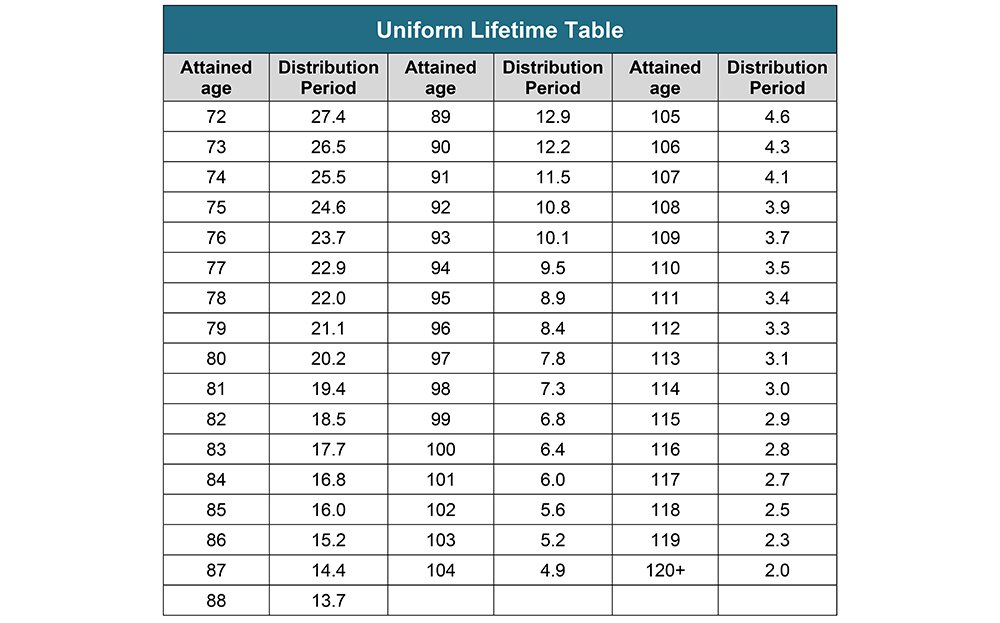

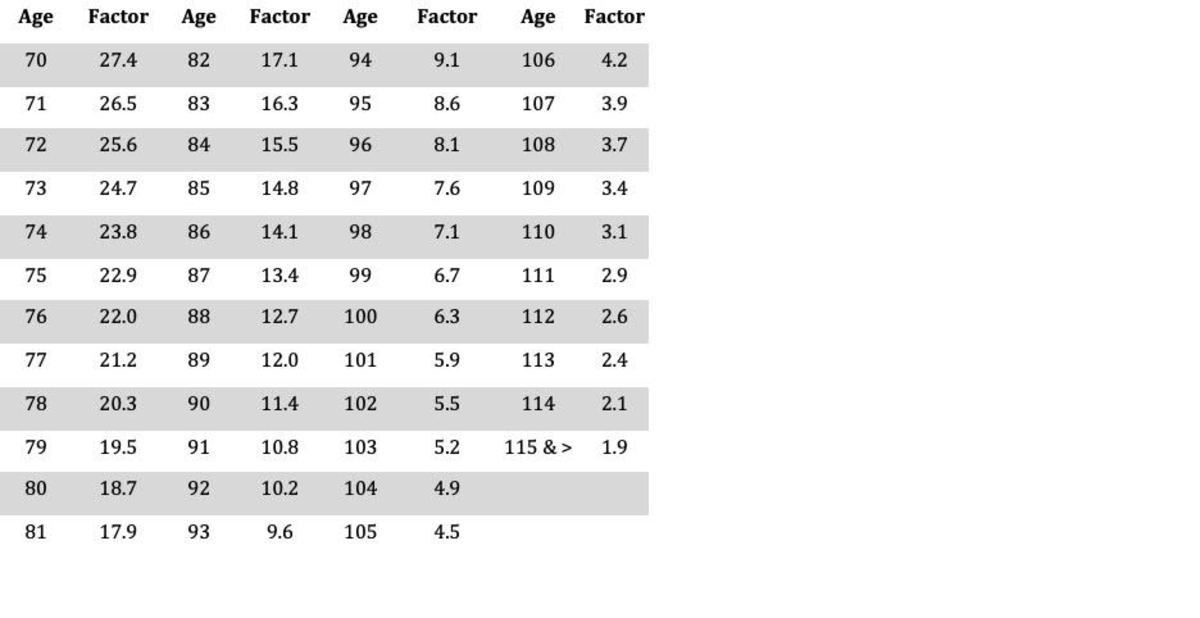

36 rows This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from an inherited IRA based on the IRS single life expectancy. Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take.

These amounts are often called required minimum distributions RMDs. Learn More About Inherited IRAs. Ad All You Need To Know About Inherited IRA RMD.

Inherited IRA Roth IRA Inherited IRA Rules. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. As a beneficiary you may be required by the IRS to take.

Account balance as of December 31 2021. Schwab Can Help You Through The Process. Distribute using Table I.

For account owners born after June 30 1949 the RBD is April 1 of the year after the. We offer bulk pricing on orders over 10 calculators. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs.

How To Calculate RMD For Inherited IRAs. Determine beneficiarys age at year-end following year of owners. The RBD is the date the original account owner would have had to start taking RMDs.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Your life expectancy factor is taken from the IRS. Beneficiary Date of Birth mmddyyyy.

This calculator has been updated to reflect the new. Enjoy Tax-Deferred Growth No Early Withdrawal Penalty When You Open An Inherited IRA. The account balance as of December 31 of the previous year.

You must take your first RMD for 2021. Calculate your earnings and more. If you want to simply take your.

RMD amounts depend on various factors such as the decedents age at death the year of death the type of. The SECURE Act of 2019 changed the age that RMDs must begin. How is my RMD calculated.

Ad Use This Calculator to Determine Your Required Minimum Distribution. The RMD rules are different for each choice so consider. Find Out What You Need To Know - See for Yourself Now.

Determine the required distributions from an inherited IRA. Ad Inherited an IRA. In general your age and acc.

Beneficiaries of a retirement plan can choose to keep the assets in a tax-deferred inherited IRA account. If you were born. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. The IRS generally requires nonspouse inherited IRA owners to start taking required minimum. RMDs for Inherited IRAs are calculated based on two factors.

Once the factor is determined it can be divided into the December 31 2020 balance to get the RMD amount for 2021. Rmd Calculator For Inherited Ira Etoro 2021 Online. RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so.

Inherited IRAs - if your IRA or retirement plan account was inherited from the original owner.

Rmd Table Rules Requirements By Account Type

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Inherited Ira Rmd Calculator Td Ameritrade

Required Minimum Distribution Rules Sensible Money

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

What Is A Required Minimum Distribution Taylor Hoffman

Your Search For The New Life Expectancy Tables Is Over Ascensus

Your Search For The New Life Expectancy Tables Is Over Ascensus

Required Minimum Distributions For Retirement Morgan Stanley

What Are Required Minimum Distributions Rmd S Meld Financial

Required Minimum Distributions Tax Diversification

Rmd Table Rules Requirements By Account Type

Where Are Those New Rmd Tables For 2022

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Calculator Required Minimum Distributions Calculator

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

What Is A Required Minimum Distribution Taylor Hoffman