Singapore Savings Bond

For as little as S500 you can. Web Singapore Savings Bonds SSBs are risk-free and flexible investments issued and backed by the Singapore government that offer step-up interest.

Singapore Savings Bond Allotment Up To S 13 500 Per Person

The Monetary Authority of Singapore MAS has launched the.

. Web Savings Bonds Safe and flexible bonds for individual investors. Web Earn up to 315 pa. Up to 10 years SGS Bonds Tradable government debt securities that pay a fixed coupon every 6.

Web This basic calculator illustrates the relationship between SGS bond prices and yields. Savings Bonds are a special. Web Singapore Savings Bonds are classified as prescribed capital markets products and Excluded Investment Products as defined in MAS Notice SFA 04-N12 and MAS Notice.

Some investors may be disappointed that the 1-year. Web Singapore Savings Bonds SSBs are a type of Singapore Government Securities that are issued for investors who want to participate in the Singapore Government Securities. Even for other Singapore Government Securities we still need.

Web The Singapore Government backs this bond and its available for you to invest if you have a CDP or SRS account this includes Singapore Permanent Residents. A safe and flexible way to save for the long term. The 10-year average return for the November issue of the Singapore Savings Bonds has hit 321 per cent a record high since the instrument was.

Today as interest rates. Web 2 hours agoSingapore-based multi-family office Farro Capital says it has amassed more than 1 billion in assets under management just four months after it launched highlighting. Web 16 hours agoINTEREST rates on the latest issuance of Singapore Savings Bonds SSBs which opened on Wednesday Mar 1 have risen again following a series of.

If you are interested in a particular bond use this calculator to compute the. Singapore Savings Bonds SSBs provide you with a simple and low-cost way to generate safe returns. Web The Monetary Authority of Singapore publishes new bonds each month with varying interests.

Web The Singapore Savings Bonds were launched in 2015. With a minimum 500 in the latest Singapore Savings Bond. To give you a clearer picture of Singapore Savings Bonds lets.

Web Bond Details SSB Calculator Want to know how much interest youll earn each year. Web Many corporate bonds in the market require us to investment 100000 or even 250000 in them. Web Interest Rates of Outstanding Savings Bonds.

Web Investors looking to generate income from investments with a similar redemption flexibility can look beyond SSBs. Select a Savings Bond enter your desired investment amount and hit SUBMIT. Back then interest rates were around 3-4 but dropped to below 15 in 2020.

Amid the search for returns and safety in a volatile market one investment product has been gaining attention of late the Singapore Savings.

Singapore Savings Bond Straits Virtual Office Singapore

Singapore Savings Bond Ssb January 2023 Guide

Singapore Savings Bond Ssb Rates And Allocation Dropped Do Not Apply Until You Ve Watched This Youtube

Singapore Savings Bond Ssb Review On The Interest Rates

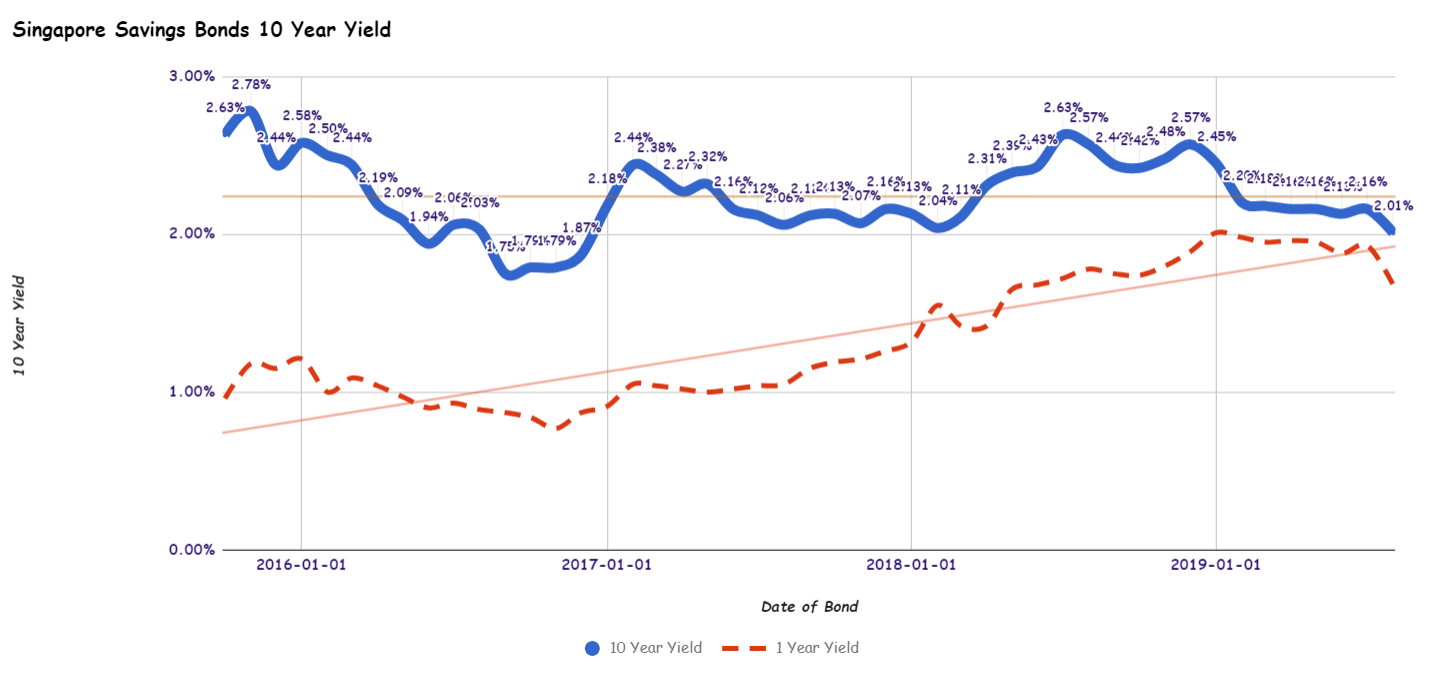

Singapore Savings Bonds Ssb August 2019 Issue Yields 2 01 For 10 Year And 1 68 For 1 Year Investment Moats

Should You Apply For The Singapore Savings Bonds Now Mybeautycravings

Singapore Savings Bonds Ssb February 2022 Short Term Yield Goes Up To 0 52 Investment Moats

Latest Singapore Savings Bonds Ssb Mar 2023 Guide Ssb Interest Rate Ssb Info How To Buy Ssb Singapore

Singapore Savings Bond 2023 Interest Rate Yield How Ssb Works

Singapore Savings Bonds Ssbs Interest Above 3 Worth A Relook Mar 2023

The Unspoken Risk With Singapore Savings Bond Treasury Bills Syfe

Singapore Savings Bonds Ssbs Guide April 2019 Issue Risk N Returns

Singapore Savings Bond Ssb Offers Up To 2 9 P A In The Latest Bond Apply By 23 February 2023

1 23 Feb 2018 Singapore Savings Bond Ssb This Month S Bond Sg Everydayonsales Com

Is The Supercharged 3 21 Nov Singapore Savings Bond A Buy

Sbsep22 Gx22090z Is 2 8 My Sweet Retirement

Singapore Savings Bonds And Its Historical Trends